Maximize Tax Savings with Qualified Opportunity Funds

Selling a business, property, or stock with significant gains? Reinvest in a Qualified Opportunity Fund to take advantage of deferral options and reduce your tax burden, all while investing in meaningful projects.

Understanding Qualified Opportunity Zones

Qualified Opportunity Zones are areas selected by the government for revitalization efforts. Investing here not only offers the potential for tax deferral and reduction but also provides the chance to contribute to the development and improvement of these communities.

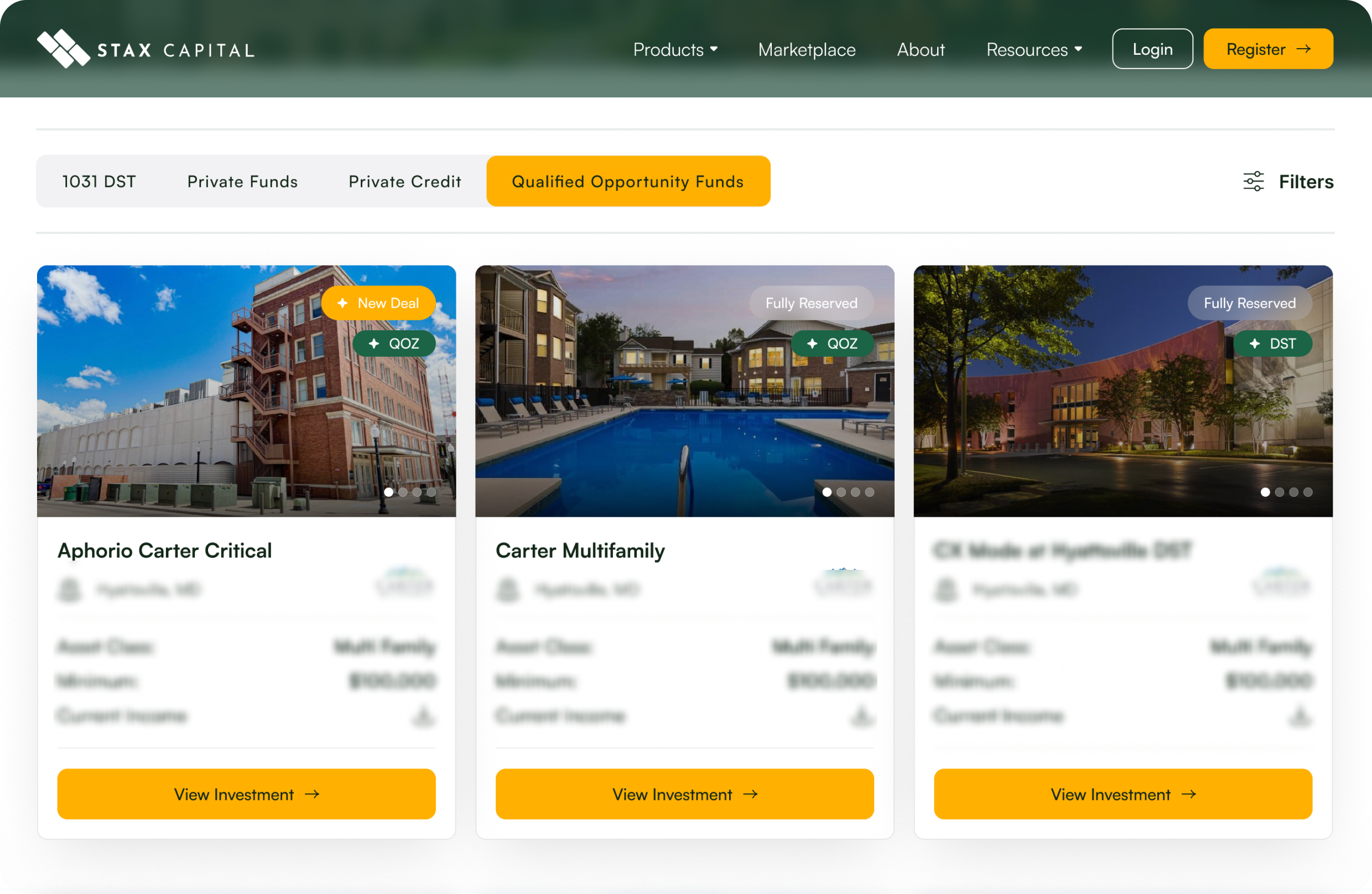

Featured Qualified Opportunity Funds

Explore our hand-picked Qualified Opportunity Funds to maximize your tax benefits while supporting economic development. Invest confidently, knowing your capital drives both financial growth and positive change.

Trilogy QOF Fund

- Asset Class: Multi Family

- Minimum: $100000

- Current Income No current income

Key Highlights

Optimized Tax Benefits: Our team helps you take full advantage of tax deferral and exemption opportunities under current QOF regulations. We do not however give tax advice and all investors considering a QOF should consult their tax advisor.

Carefully Vetted Opportunities: Each fund undergoes strict analysis to ensure you invest in opportunities backed by experienced managers.

Custom Portfolio Solutions: We work with you to design a QOF investment strategy tailored to your financial goals and risk tolerance.

Sponsor Assets Under Management

Real Estate offered on our platform

Highly-vetted investments from institutional DST managers

Access to a broad array of asset types

Maximize Benefits with Qualified Opportunity Funds

At Stax, we provide access to pre-vetted Qualified Opportunity Funds managed by industry leaders. You’ll benefit from a combination of tax savings, professional fund management, and the chance to invest in thriving industries.

Access unique QOF funds with experienced real estate sponsors.

Invest in key sectors through selected QOF funds, providing you with the potential to diversify and expand your investment reach.

Featuring Best in Class Fund Managers

Collaborate with some of the highly experienced in Class Fund Managers in the industry, ensuring professional management and effective strategies to managing your investments.

Exclusive Opportunities with Stax

Experience the advantage of working with Stax—where our deep expertise and tailored approach guide you in optimizing potential tax benefits of QOF investments.

Download the Complete QOZ Guide

Discover how investing in Qualified Opportunity Zones could enhance your portfolio while offering tax incentives. Download the guide to get started on your QOZ journey.

Download the Complete QOZ Guide

Discover how investing in Qualified Opportunity Zones could enhance your portfolio while offering tax incentives. Download the guide to get started on your QOZ journey.

Put Your Capital Gains to Work

When you invest in properties through a qualified opportunity fund, you’re not only eligible for significant tax benefits, you’re also revitalizing up-and-coming communities by creating more jobs, driving business, and expanding housing.

2024

Year 1

Invest capital gains from prior investment into a Qualified Opportunity Fund and begin deferring tax

2027

Year 3

Pay taxes on original federal capital gains

2035 - 2048

Year 10+

Pay no federal capital gains taxes on the gain from the sale of the QOF investment

QOZ Legislation

In 2017, the Tax Cuts and Jobs act established a new tax incentive to encourage investments in over 8,000 designated opportunity zones that haven't seen significant capital investment in decades.

When you invest in properties through qualified opportunity fund, you're not only eligible for significant tax benefits. You're also revitalizing up-and-coming communities by creating more jobs, driving business and expanding housing.

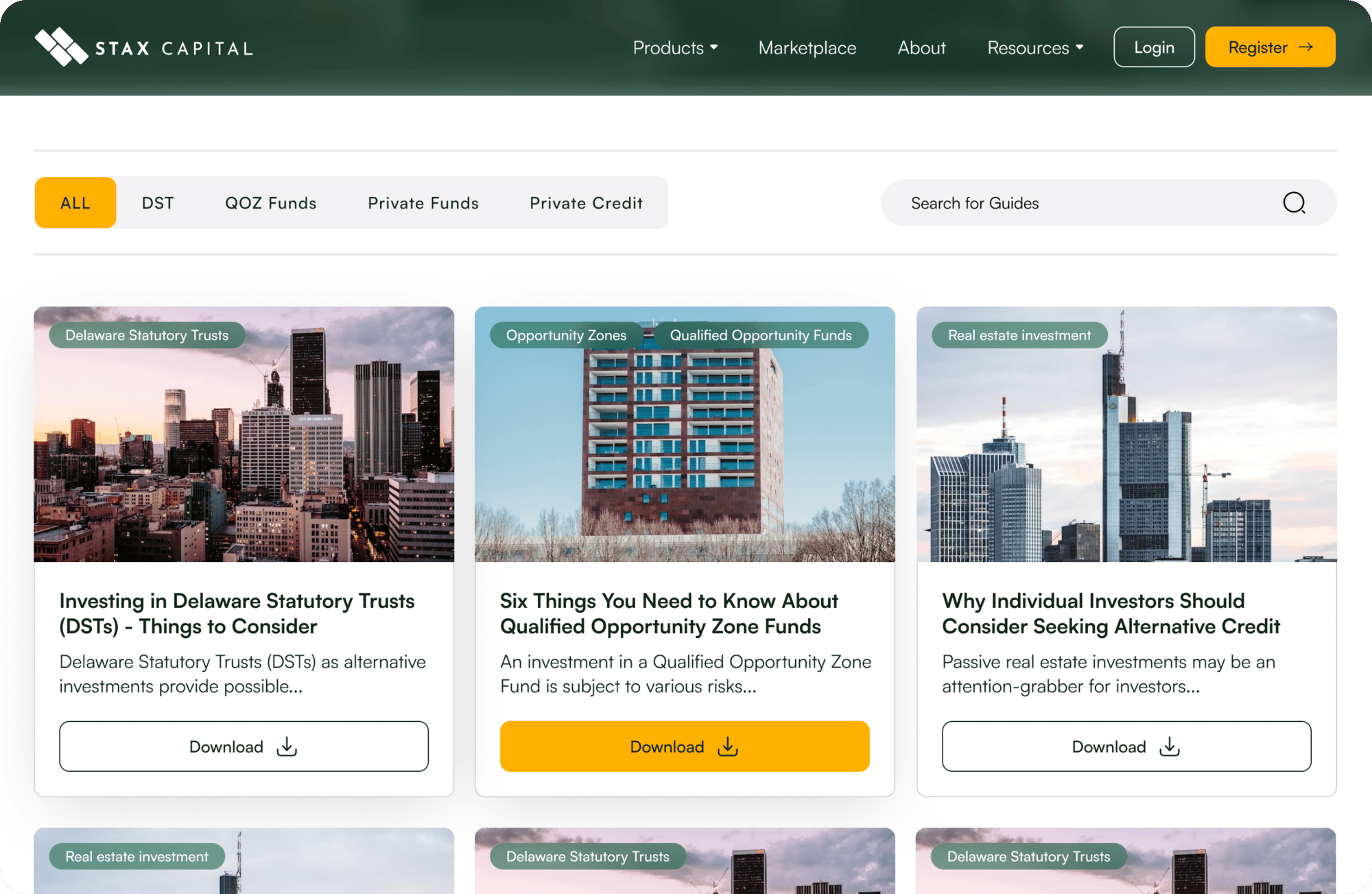

Market Insights

Gain access to our latest market insights with downloadable guides covering key trends, industry developments, and investment opportunities.

.png?width=826&height=502&name=Qualified%20Opportunity%20Funds%20A%20simple%20guide%20(1).png)

- Qualified Opportunity Funds

Qualified Opportunity Funds: A simple guide

An alternative option that can be explored by real estate investors looking to diversify their portfolio and take advantage of possible tax benefits is the Qualified Opportunity Zone investment opportunity. What is a Qualified Opportunity Fund? It’s a vehicle for investing in these zones, offering potential tax advantages. Here are some of the important things to know about investing in Qualified Opportunity Zones through Qualified Opportunity Funds.

Read More

%202021%20Update%20(1).png?width=826&height=502&name=Qualified%20Opportunity%20Funds%20(QOFs)%202021%20Update%20(1).png)

- Qualified Opportunity Funds

Qualified Opportunity Funds (QOFs): 2021 Update

One year after a global lockdown triggered by the COVID-19 outbreak

Read More

- Qualified Opportunity Funds

How to Defer and Eliminate Capital Gains Through QOZ Investments

Are taxes eating into your investment profits? What if you could delay or even avoid paying those taxes entirely? Qualified Opportunity Zones (QOZs) make this possible, giving investors a chance to defer and potentially eliminate capital gains taxes. However, these benefits come with specific IRS requirements and investment risks that should be carefully evaluated.

Read More

Stax at a Glance

At Stax, our extensive experience and industry partnerships provide access to exclusive private investment opportunities. From 1031 DST exchanges to private equity and credit, we deliver investment strategies backed by some of the industry's most trusted sponsors.

Learn MoreCombined Leadership Experience

35 YEARS

Private Investments Offered Through Stax

$12.3 BILLION

Our Sponsors Assets Under Management

$200 BILLION

Case Stories

Explore firsthand experiences of clients who have successfully transitioned to passive income, built wealth, and diversified their portfolios with our guidance.

Stax made my transition to passive income smooth and stress-free.

Stax helped Shikha complete a 1031 exchange into DSTs, freeing her from property management and allowing her to focus on personal time.

-Shikha

Stax helped me shift to passive income and defer my taxes.

Stax guided Ramesh through a successful 1031 exchange and DST investments, allowing him to defer taxes and enjoy hassle-free income.

-Ramesh

Stax made it easy to switch to passive investments for our retirement.

Stax introduced Sima and Roman to DSTs, allowing them to shift from active property management to a hands-off strategy while maintaining a steady income.

-Sima and Roman

Disclosure

The experiences shared by clients of Stax Capital were given voluntarily without any compensation. These testimonials reflect individual opinions and are not intended as investment advice or guarantees of future results. Each investor should consider their own financial goals, risk comfort, and overall situation before making any investment choices.

Understanding the Benefits and Risks of Qualified Opportunity Funds

Unlock Powerful Tax Benefits and Understand the Potential Risks Involved in QOF Investments

Benefits

Risks

Tax Deferral

Investing in a QOF within 180 days of a sale lets you defer capital gains taxes until the end of 2026. This gives you the time to reinvest and potentially expand your wealth without immediate tax implications.

Tax-free gains

By keeping your investment in a QOF for at least 10 years, you won’t need to pay taxes on the capital gains earned. This way you can increase your overall returns over the long term significantly.

Tax-Free Growth

QOFs offer the ability to keep your funds invested without additional capital gains tax until 2047. This gives you decades to potentially grow your wealth without capital gains taxes.

Diversified Opportunities

QOFs provide access to a variety of asset classes. This can further help balance your portfolio while spreading risk across different types of properties and sectors.

Speculative Investments

QOFs depend on market projections that may not materialize as expected. If these assumptions prove incorrect, it could lead to potential financial losses.

Illiquid Investment

There is no established market for QOF interests, making it difficult to sell or liquidate your investment. This means you need to be prepared for the long-term commitment.

Tax Risks

QOF tax rules can change, impacting the benefits you receive. Future changes could impact your investment returns and benefits, so staying informed about updates is important.

Regulatory Risk

The regulatory framework governing QOZ investing is still evolving. Future adjustments could impact your investment, and it’s important to stay informed about these changes.

Our Partners

Our network of industry-leading partners provides best-in-class investment managers, expert tax advisors, and solution-driven product developers. Together, we deliver exceptional investment solutions tailored to your needs.

Our Leadership Team

Our leadership team combines extensive knowledge of private markets with a shared dedication to putting clients first. We work closely with you, educating you on the pros and cons to ensure the decisions we help you make align with your long-term financial goals.

Founder & CEO

Founder & CEO

Stacey Morimoto

i Due Diligence and Operations

Due Diligence and Operations

Quinn Morimoto

i Compliance Principal

Compliance Principal

Jason Finley

i

Stacey Morimoto

Mr. Morimoto leverages over 20 years of experience in the securities industry to help his clients navigate the complexities of alternative investments.

After starting his career at Salomon Smith Barney and recognizing the limitations of the traditional wirehoue platform, Stacey became an independent financial representative and established his own securities broker dealer.

Through DST investments, he saw a unique opportunity to deliver real value to clients that larger firms couldn’t offer. The ability to improve the overall day-to-day quality of people’s lives, beyond just their finances, is still what drives him.

With Stax Capital, a boutique firm that prioritizes individual attention, Stacey’s mission is to deliver the best possible educational experience for investors, so that they can make the right decision for themselves.

Quinn Morimoto

Son of founder and CEO Mr. Stacey Morimoto, Quinn has benefitted from early exposure to the inner workings of the securities industry. With a degree in finance from the University of San Diego, he heads up the due diligence and underwriting for all the DST offerings brought to the Stax Platform, a process that includes gathering appraisals, third party reports, and legal opinions as well as recreating sponsors’ financial models. He dives deep into the numbers and analyzes offers from every angle, looking for flaws, in order to minimize as much risk as possible for investors. Quinn has directly facilitated hundreds of private placement investment transactions and would say that the best part of the job is being able to truly make a lasting impact on people’s lives.

Jason Finley

With two decades of experience in sales and marketing across prestigious golfing, technology, and non-profit sectors, Mr. Finley has consistently embraced roles centered on helping others. He firmly believes that enjoying your work makes it effortless, which is why he cherishes being part of the Stax Capital family.

Educating investors on often-overlooked investment opportunities to help them grow their wealth, achieve tax efficiency, and plan for the future brings him immense satisfaction. From the onboarding process to discussing investment options, Jason is dedicated to ensuring every client receives the highest level of service when working with Stax Capital.

Jason is a graduate of the FINRA Institute at Georgetown Certified Regulatory and Compliance Professional (CRCP) program, further enhancing his expertise and commitment to providing exceptional service and compliance in the financial sector. He also holds the Series 22, 7, and 24 securities licenses, underscoring his comprehensive knowledge and regulatory compliance proficiency.

Hear from Our Clients & Industry Experts

Explore real-life success stories and get expert opinions on the value of 1031 DST exchanges and private market investments.

"Stacey and his team understand our needs and risk tolerance. When we have questions on current investments they're easily reached. I highly recommend them."

Julie Swail

Client

"The first time I met with Stax to discuss my options, I felt a level of comfort and security with their professionalism, their knowledge of the options that I could use, and their extreme sense of care in ensuring that my investments were as safe as possible but would also continue to grow as a legacy for my family."

Carol Deters

Client

"Stax Capital keeps impeccable due diligence compliance files that will protect issues in case of an examination. In addition, Stacey is a pleasure to work with in securities offerings."

Richard Weintraub

Securities Attorney

"I have been so impressed with Stax that as a 34-year Corporate Banker, I have proudly introduced Stax to past clients, colleagues, family and friends."

Paul Champlin

Client

"My exchanges were accomplished in a very timely and efficient manner. Thank you to Stacey, your colleagues and Stax Capital!"

Eric Lindquist

Client

"Stax deals with people with respect and patience and will never advise a client to pursue an investment which is not proper for them. Because of their experience, they are able to analyze properties, markets and companies that are best suited for their clients. They are a great resource to investors in real estate."

Paul Spring

President, Exchange Resources 1031

"I wanted to thank the Stax team for the incredible service that you provide to our customers. We all know that real estate transactions can be extremely stressful, especially when a 1031 exchange is involved – but your team comes through 'cool as a cucumber' every time. Your customer service, knowledge and strategic approach to investing in DST’s is off the charts!"

Stephen Decker

Qualified Intermediary

Disclosure

The experiences shared by clients of Stax Capital were given voluntarily without any compensation. These testimonials reflect individual opinions and are not intended as investment advice or guarantees of future results. Each investor should consider their own financial goals, risk comfort, and overall situation before making any investment choices.

Frequently Asked Questions

By investing in a QOF, you can defer capital gains taxes until the end of 2026. Additionally, if the investment is held for at least 10 years, any capital gains realized from the QOF investment itself can be excluded from taxes. This allows investors to maximize their tax savings while growing their investments over time.

To qualify for tax-free gains on the appreciation of your QOF investment, you must hold your investment for a minimum of 10 years. However, the deferral on the original capital gains is available until December 31, 2026, regardless of how long you hold the investment.

No, QOF investments are typically illiquid. There is no public market for QOF interests, and selling an interest may be difficult or even impossible. Investors should be prepared for a long-term commitment and consult their financial advisor before investing.

Yes, QOFs carry several risks, including the speculative nature of the investment and reliance on market assumptions that may not materialize. Real estate investments are also exposed to economic risks such as inflation, recessions, and market fluctuations. Additionally, there are regulatory and tax risks, as the rules surrounding QOFs may change, potentially affecting investor benefits.

While you can exit a QOF before the 10-year period, doing so may reduce or eliminate the tax benefits. If you sell or withdraw your investment before the full term, the original deferred capital gains taxes will become due, and you may not benefit from the tax-free growth on new gains. Always consult a tax professional for advice on early exits.

Connect

With Us

Our personalized approach ensures that we thoroughly understand your unique circumstances, aspirations, and any queries you may have. Whether you choose to fill out the form below or give us a call, rest assured that you’ll receive a prompt response and expert guidance.