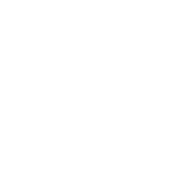

Unlock Steady Income with Private Credit Investments

Invest in private credit to achieve steady income while diversifying beyond traditional markets. Our carefully selected credit funds provide access to top-tier opportunities in the private credit space.

Alternative Investments Benefits

Alternative investments, such as private credit, offer a unique opportunity to diversify your portfolio and generate steady income. By stepping beyond traditional stocks and bonds, private credit provides access to secured lending opportunities that can deliver regular cash flow, even during uncertain market conditions.

Featured Private Credit Fund

Discover the potential for stable income through our featured Private Credit Fund, designed to offer consistent returns with a focus on capital preservation.

Apollo Debt Solutions Product

- Asset Class: Multi Family

- Minimum: $100000

- Current Income No current income

Key Highlights

Rigorous Due Diligence: We employ a thorough vetting process to ensure that every private credit investment aligns with your risk tolerance and long-term strategy.

Tailored Investment Solutions: Stax provides custom portfolio strategies that fit your unique financial needs, helping you maximize income while minimizing risk.

Access to Top Opportunities: Gain access to a diverse range of private credit investments diversified across various industries, supported by industry-leading managers.

Sponsor Assets Under Management

Real Estate offered on our platform

Highly-vetted investments from institutional DST managers

Access to a broad array of asset types

Unlock the Power of Private Credit Investments

Discover how Stax’s private credit investments offer reliable income and a diversified portfolio with expert support at every step.

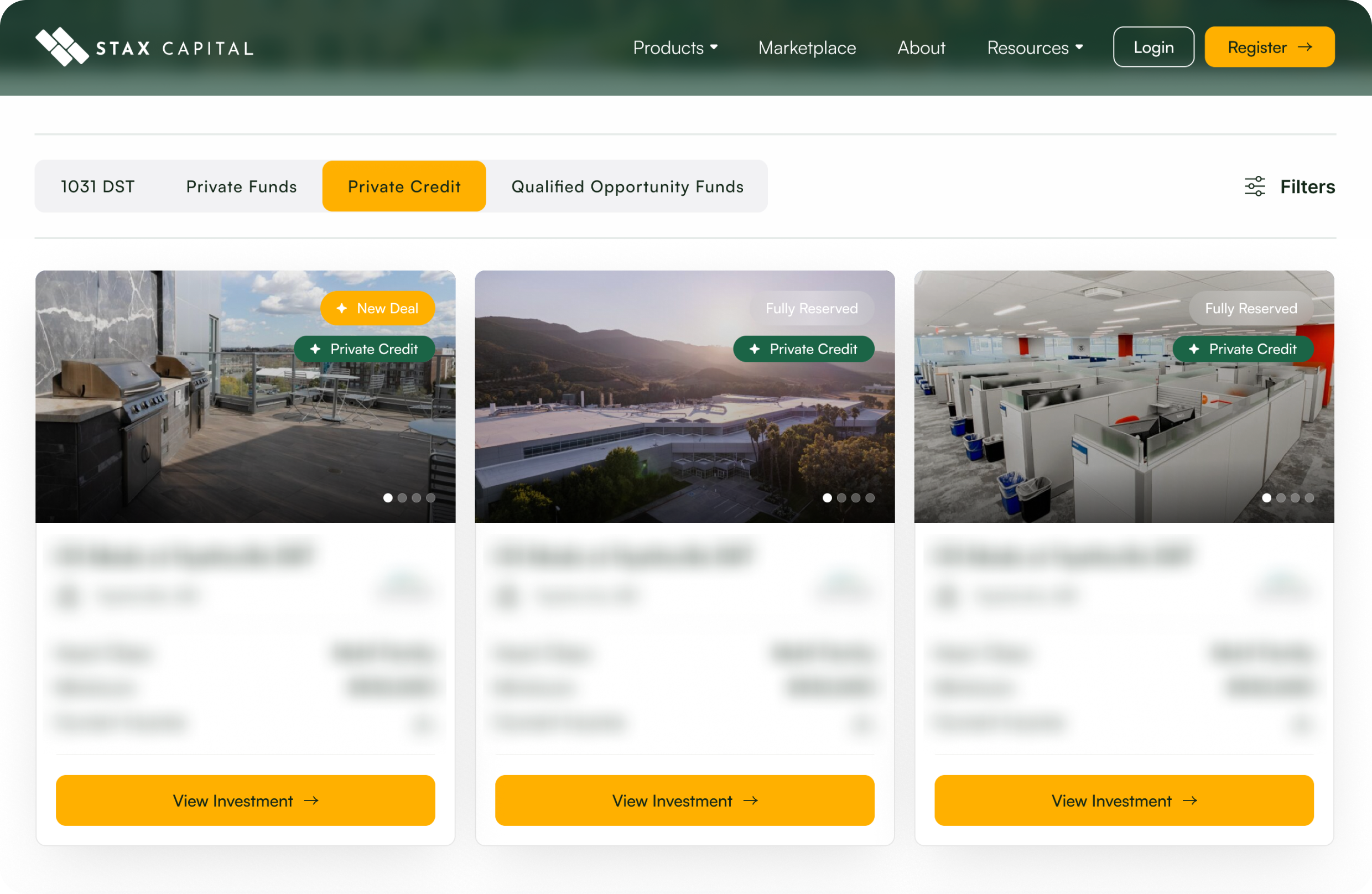

Access to Exclusive Opportunities

Our strong industry relationships provide access to top-tier private credit funds that are typically reserved for institutional investors.

Personalized Investment Solutions

We provide a tailored approach to private credit, matching investment opportunities with your financial goals and risk tolerance.

Comprehensive Due Diligence

We rigorously vet every private credit investment opportunity to ensure that it fits within your risk tolerance and long-term financial strategy.

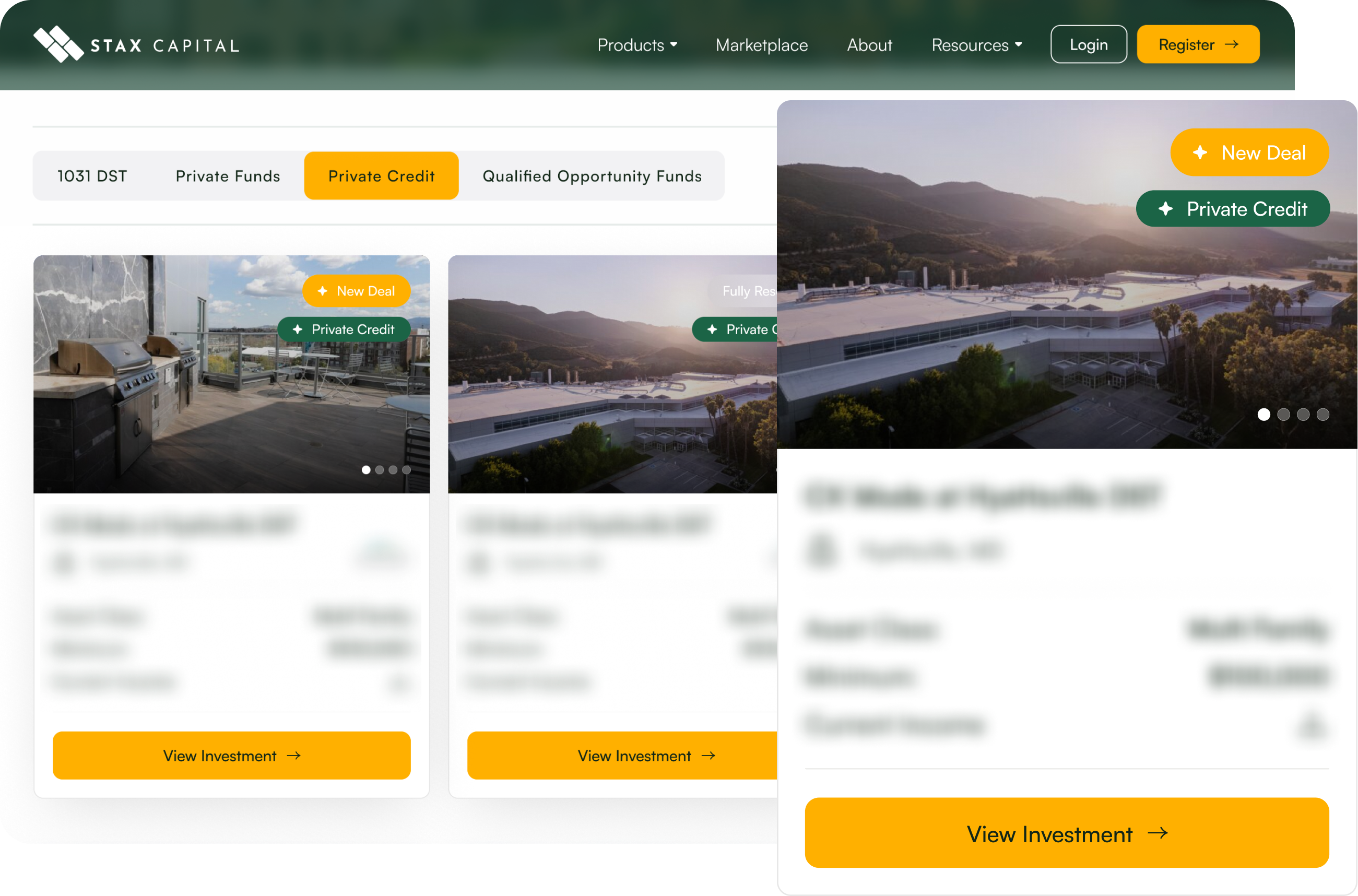

Download Your Guide to Private Credit Fund

Discover how private credit funds can offer potential income streams and diversify your portfolio. Download the guide to see if this investment fits your financial strategy.

Download Your Guide to Private Credit Fund

Discover how private credit funds can offer potential income streams and diversify your portfolio. Download the guide to see if this investment fits your financial strategy.

Private Credit Legislation

Private credit investments operate within a robust regulatory framework designed to protect investors and maintain market integrity.

Governed by federal securities laws and regulations from bodies like the SEC and FINRA, private credit investments follow strict compliance standards. This regulatory oversight ensures transparency, fair practices, and investor protection, making private credit a reliable alternative investment option for those seeking consistent income with minimized risk.

Market Insights

Gain a deeper understanding of the rapidly evolving private credit market. Our comprehensive market insights delve into the latest trends, risks, and opportunities within this space.

.png?width=826&height=502&name=Direct%20Participation%20Programs%20-%20What%20you%20need%20to%20know%20(1).png)

- Real Estate Investment

Direct Participation Programs - What you need to know

If you are searching for alternative channels for real estate investing, Direct Participation Programs (DPPs) may be an effective approach to investment diversification. DPPs for property investors are often in institutional quality investments and provide a means to explore possible benefits of a market that is not directly correlated to traditional investment assets.

Read More

- Real Estate Investment

5 Things to Consider When Investing in Real Estate

Investing in real estate can be a rewarding venture, yet it may be complex and tasking. The real estate market offers opportunities for investment diversification with the possibility of potential gains — through rental income, dividends or capital gains. Various types of real estate investments exist in the market with different forms of operations.

Read More

- Real Estate Investment

10 Real Estate Investment Strategies to Maximize Your Returns

Real estate goes beyond buying and selling—it’s about implementing strategies tailored to your financial goals. With the right approach, you can optimize your investment potential while navigating inherent risks. From flipping homes to diversifying your portfolio, there are plenty of ways to maximize your real estate investment profits.

Read More

Stax at a Glance

At Stax, our extensive experience and industry partnerships provide access to exclusive private investment opportunities. From 1031 DST exchanges to private equity and credit, we deliver investment strategies backed by some of the industry's most trusted sponsors.

Learn MoreCombined Leadership Experience

35 YEARS

Private Investments Offered Through Stax

$12.3 BILLION

Our Sponsors Assets Under Management

$200 BILLION

Case Stories

Explore firsthand experiences of clients who have successfully transitioned to passive income, built wealth, and diversified their portfolios with our guidance.

Stax made my transition to passive income smooth and stress-free.

Stax helped Shikha complete a 1031 exchange into DSTs, freeing her from property management and allowing her to focus on personal time.

-Shikha

Stax helped me shift to passive income and defer my taxes.

Stax guided Ramesh through a successful 1031 exchange and DST investments, allowing him to defer taxes and enjoy hassle-free income.

-Ramesh

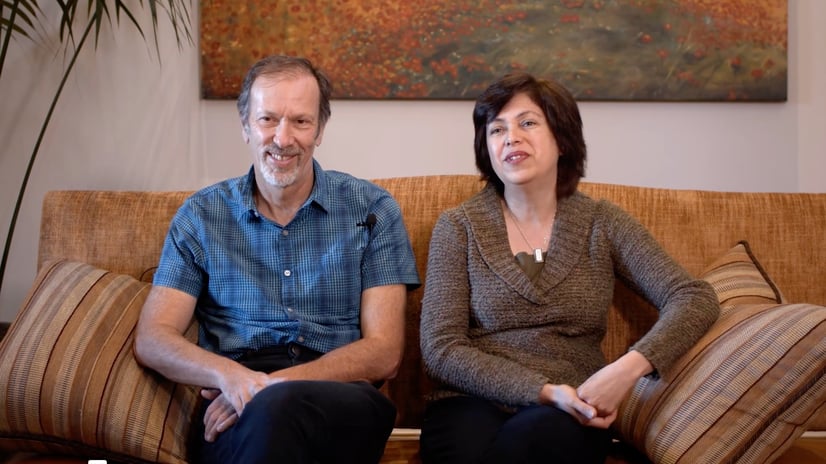

Stax made it easy to switch to passive investments for our retirement.

Stax introduced Sima and Roman to DSTs, allowing them to shift from active property management to a hands-off strategy while maintaining a steady income.

-Sima and Roman

Disclosure

The experiences shared by clients of Stax Capital were given voluntarily without any compensation. These testimonials reflect individual opinions and are not intended as investment advice or guarantees of future results. Each investor should consider their own financial goals, risk comfort, and overall situation before making any investment choices.

Understanding the Risks and Benefits of Private Credit Investments

Private credit offers a unique opportunity to achieve steady income and diversify your investment portfolio. However, it is essential to balance the benefits with the associated risks to make informed decisions.

Benefits

Risks

Consistent Income Generation

Private credit investments are structured to provide regular income, typically through interest payments. This makes them a suitable option for investors seeking predictable cash flow.

Portfolio Diversification

By investing in private credit, you can reduce exposure to traditional equity and bond markets. This helps you balance your overall portfolio and potentially mitigate market volatility.

Customized Investment Solutions

Private credit funds often offer flexible investment structures, allowing for tailored solutions. These funds can align with your income objectives and risk tolerance.

Risk Mitigation

Private credit investments are often backed by tangible collateral, such as real estate or other valuable assets. This way, you can safeguard your investment in the event of borrower default.

Illiquidity

Private credit investments are typically illiquid, meaning they are not easily sold or traded on public markets. Investors must be prepared for long-term commitments without access to their capital.

Credit Risk

There is always the possibility that borrowers may default on their payments, leading to a potential loss of income or capital. Thorough due diligence helps mitigate, but cannot eliminate this risk.

Economic Sensitivity

Private credit investments may be affected by broader economic factors, such as rising interest rates or an economic downturn, which could impact borrowers' ability to meet repayment obligations.

Limited Transparency

Private credit funds may offer less transparency compared to public investments, making it more difficult to assess the ongoing performance or potential risks associated with the investment.

Our Partners

Our network of industry-leading partners provides best-in-class investment managers, expert tax advisors, and solution-driven product developers. Together, we deliver exceptional investment solutions tailored to your needs.

Our Leadership Team

Our leadership team combines extensive knowledge of private markets with a shared dedication to putting clients first. We work closely with you, educating you on the pros and cons to ensure the decisions we help you make align with your long-term financial goals.

Founder & CEO

Founder & CEO

Stacey Morimoto

i Due Diligence and Operations

Due Diligence and Operations

Quinn Morimoto

i Compliance Principal

Compliance Principal

Jason Finley

i

Stacey Morimoto

Mr. Morimoto leverages over 20 years of experience in the securities industry to help his clients navigate the complexities of alternative investments.

After starting his career at Salomon Smith Barney and recognizing the limitations of the traditional wirehoue platform, Stacey became an independent financial representative and established his own securities broker dealer.

Through DST investments, he saw a unique opportunity to deliver real value to clients that larger firms couldn’t offer. The ability to improve the overall day-to-day quality of people’s lives, beyond just their finances, is still what drives him.

With Stax Capital, a boutique firm that prioritizes individual attention, Stacey’s mission is to deliver the best possible educational experience for investors, so that they can make the right decision for themselves.

Quinn Morimoto

Son of founder and CEO Mr. Stacey Morimoto, Quinn has benefitted from early exposure to the inner workings of the securities industry. With a degree in finance from the University of San Diego, he heads up the due diligence and underwriting for all the DST offerings brought to the Stax Platform, a process that includes gathering appraisals, third party reports, and legal opinions as well as recreating sponsors’ financial models. He dives deep into the numbers and analyzes offers from every angle, looking for flaws, in order to minimize as much risk as possible for investors. Quinn has directly facilitated hundreds of private placement investment transactions and would say that the best part of the job is being able to truly make a lasting impact on people’s lives.

Jason Finley

With two decades of experience in sales and marketing across prestigious golfing, technology, and non-profit sectors, Mr. Finley has consistently embraced roles centered on helping others. He firmly believes that enjoying your work makes it effortless, which is why he cherishes being part of the Stax Capital family.

Educating investors on often-overlooked investment opportunities to help them grow their wealth, achieve tax efficiency, and plan for the future brings him immense satisfaction. From the onboarding process to discussing investment options, Jason is dedicated to ensuring every client receives the highest level of service when working with Stax Capital.

Jason is a graduate of the FINRA Institute at Georgetown Certified Regulatory and Compliance Professional (CRCP) program, further enhancing his expertise and commitment to providing exceptional service and compliance in the financial sector. He also holds the Series 22, 7, and 24 securities licenses, underscoring his comprehensive knowledge and regulatory compliance proficiency.

Hear from Our Clients & Industry Experts

Explore real-life success stories and get expert opinions on the value of 1031 DST exchanges and private market investments.

"Stacey and his team understand our needs and risk tolerance. When we have questions on current investments they're easily reached. I highly recommend them."

Julie Swail

Client

"The first time I met with Stax to discuss my options, I felt a level of comfort and security with their professionalism, their knowledge of the options that I could use, and their extreme sense of care in ensuring that my investments were as safe as possible but would also continue to grow as a legacy for my family."

Carol Deters

Client

"Stax Capital keeps impeccable due diligence compliance files that will protect issues in case of an examination. In addition, Stacey is a pleasure to work with in securities offerings."

Richard Weintraub

Securities Attorney

"I have been so impressed with Stax that as a 34-year Corporate Banker, I have proudly introduced Stax to past clients, colleagues, family and friends."

Paul Champlin

Client

"My exchanges were accomplished in a very timely and efficient manner. Thank you to Stacey, your colleagues and Stax Capital!"

Eric Lindquist

Client

"Stax deals with people with respect and patience and will never advise a client to pursue an investment which is not proper for them. Because of their experience, they are able to analyze properties, markets and companies that are best suited for their clients. They are a great resource to investors in real estate."

Paul Spring

President, Exchange Resources 1031

"I wanted to thank the Stax team for the incredible service that you provide to our customers. We all know that real estate transactions can be extremely stressful, especially when a 1031 exchange is involved – but your team comes through 'cool as a cucumber' every time. Your customer service, knowledge and strategic approach to investing in DST’s is off the charts!"

Stephen Decker

Qualified Intermediary

Disclosure

The experiences shared by clients of Stax Capital were given voluntarily without any compensation. These testimonials reflect individual opinions and are not intended as investment advice or guarantees of future results. Each investor should consider their own financial goals, risk comfort, and overall situation before making any investment choices.

Frequently Asked Questions

Private credit funds are generally available to accredited investors who meet specific income or net worth requirements. These investments are often suited for individuals or institutions looking for stable income streams and portfolio diversification beyond traditional assets.

Private credit investments are typically structured to provide steady income, often paid quarterly or monthly. However, the returns depend on the borrower’s ability to meet their obligations and broader economic conditions. Returns are not guaranteed, and each investment carries different levels of risk based on its structure.

Yes, private credit funds are regulated under federal securities laws and are subject to oversight by regulatory bodies like the SEC and FINRA. These regulations ensure transparency and protect investors through strict compliance and reporting standards.

Private credit investments may offer tax advantages, such as pass-through income or depreciation benefits, depending on the fund's structure and the assets it holds. Always consult with a tax professional to understand the specific tax implications of your investment.

Yes, private credit can provide diversification by offering exposure to alternative asset classes that are not directly tied to the stock market. Including private credit in your portfolio can reduce overall portfolio volatility while adding a steady income stream.

Returns on private credit investments vary depending on the loan type, risk profile, and market conditions. Generally, private credit can offer higher returns than traditional fixed-income products due to the increased risk, but returns are not guaranteed.

Connect

With Us

Our personalized approach ensures that we thoroughly understand your unique circumstances, aspirations, and any queries you may have. Whether you choose to fill out the form below or give us a call, rest assured that you’ll receive a prompt response and expert guidance.